Abu Dhabi can be regarded more and more as a part of Silicon Wadi. Especially FinTechs are booming in Abu Dhabi due to the new economic frame of the ‘Abraham Accords’. Learn more about Abu Dhabi’s FinTechs: Subscription just $29,90/12 months (net).

The exact figure of how many fintechs really exist in UAE is also q question of definition and of reliable sources. There are some reasonable guessings that give at least an impression of the dimensions.

It is reasonable to say that about 450 fintech startups exist in the UAE. According to an IBS Intelligence report, the UAE is home to almost 50% of the region’s fintech companies. Hence, UAE is a real competitor of Tel Aviv.

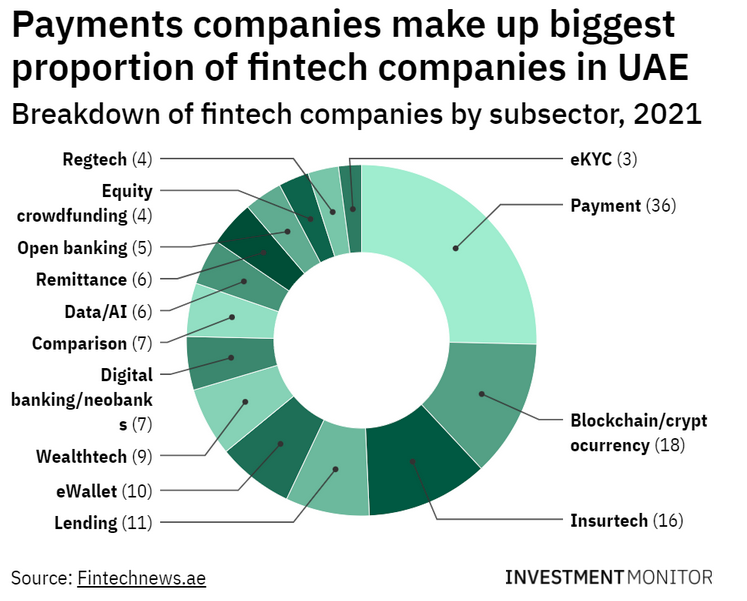

Konstatin Rabin states: “It is estimated that by 2022, about 465 fintech firms in the UAE will generate about $2 billion in investment capital funding in comparison to the $80 million in tinted investment capital raised in 2017.” Currently, the average deal size is at a record high of $2.5 million. According to IM payment companies are in focus as the graphic below for 2021 shows:

To put the figures in a global frame: On a global level about 26.000 fintech startups said to exist with about 11.000 in the USA.

Back to the UAE: “The UAE government has taken several initiatives to bolster this sector, including the launch of “Fintech Strategy 2021” in 2016 and the establishment of Dubai Smart City as well as a National Financial Technology Lab in Abu Dhabi.”, states Chishti.

The major incubator for UAE and for the MENA region in general is the DIFC FinTech Hive, located in Dubai: “DIFC FinTech Hive is the first and largest financial technology accelerator in the Middle East, Africa and South Asia (MEASA) region.

It is the only place to be if you are a FinTech, InsurTech, RegTech, Islamic FinTech startup looking to capitalise on unlimited opportunities and get your product or solution in front of the region’s most established financial service organisations.”, according to own words.

DIFC raised about $455 billion and accelerated ore than 160 startups in the fintech industry. DIFC is home to an internationally recognised, independent regulator and a proven judicial system with an English common law framework, as well as the region’s largest financial ecosystem of more than 24,000 professionals working across over 2,200 active registered companies.

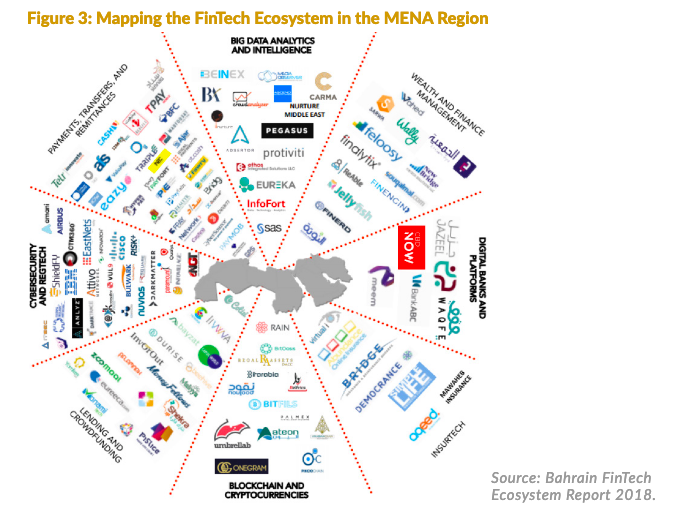

The report of the Milken Institute gives an overview, a first glance of the ecosystem of fintechs in the MENA region in general:

A first conclusion: UAE (and Bahrain) managed to set up an awesome frame for fintechs.